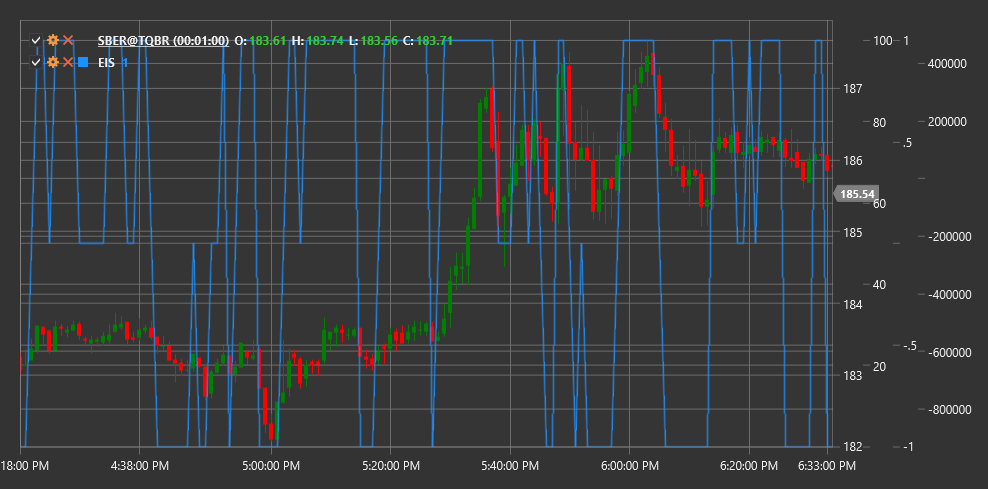

EIS

Elder Impulse System (EIS) is a technical indicator developed by Dr. Alexander Elder that combines a trend indicator and a momentum oscillator to determine the direction and strength of market movement.

To use the indicator, you need to use the ElderImpulseSystem class.

Description

The Elder Impulse System (EIS) is a simple yet powerful tool for visualizing market momentum. It combines two indicators:

- Exponential Moving Average (EMA) - to determine trend direction

- MACD Histogram - to measure price movement strength and momentum

EIS classifies each candle on the price chart into one of three categories (usually denoted by different colors):

- Green (strong bullish impulse) - when both indicators are rising

- Red (strong bearish impulse) - when both indicators are falling

- Blue or neutral (no clear impulse) - when indicators move in opposite directions

EIS is particularly useful for:

- Quickly visually determining trend direction and strength

- Identifying entry and exit points in the direction of the main trend

- Identifying potential reversal points

- Filtering out false signals

Calculation

Elder Impulse System calculation involves the following steps:

Calculate 13-period exponential moving average (EMA):

EMA = EMA(Close, 13)Calculate MACD Histogram (standard values: 12, 26, 9):

MACD Line = EMA(Close, 12) - EMA(Close, 26) Signal Line = EMA(MACD Line, 9) MACD Histogram = MACD Line - Signal LineDetermine color classification for the current candle:

If EMA[current] > EMA[previous] AND MACD Histogram[current] > MACD Histogram[previous], then Green (Bullish Impulse) If EMA[current] < EMA[previous] AND MACD Histogram[current] < MACD Histogram[previous], then Red (Bearish Impulse) Otherwise Blue (No Impulse)

Interpretation

The Elder Impulse System is interpreted as follows:

Green Candles (strong bullish impulse):

- Indicate a strong upward momentum

- Best time to buy or hold long positions

- A series of green candles indicates a strong upward trend

Red Candles (strong bearish impulse):

- Indicate a strong downward momentum

- Best time to sell or hold short positions

- A series of red candles indicates a strong downward trend

Blue Candles (no clear impulse):

- Indicate uncertainty or consolidation

- Signal a possible slowdown or trend reversal

- Often appear during consolidation periods or before a trend change

Trading Strategies:

- Buy when candles change color from blue to green

- Sell when candles change color from blue to red

- Close long positions when candles change color from green to any other

- Close short positions when candles change color from red to any other

Trend Confirmation:

- A sequence of green candles confirms an upward trend

- A sequence of red candles confirms a downward trend

- Color alternation indicates a sideways trend or uncertainty