DC

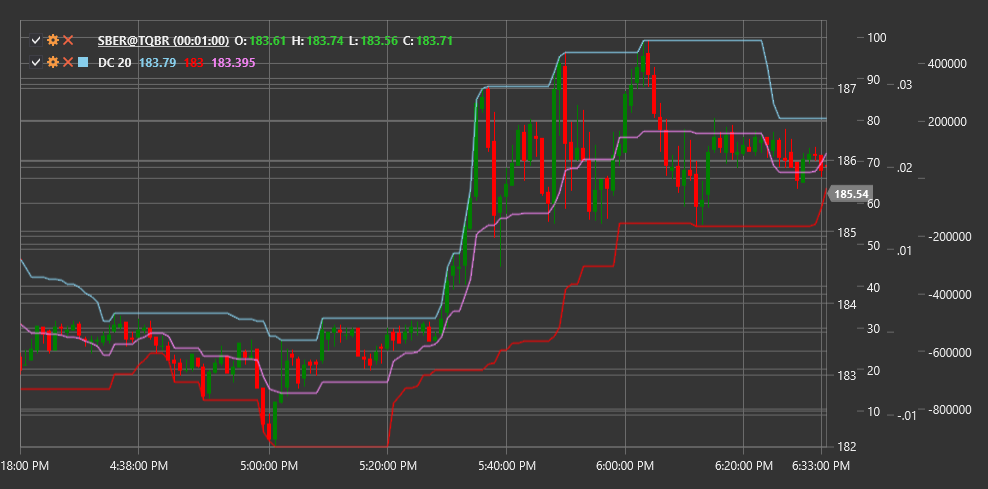

Donchian Channels (DC) is a technical indicator developed by trader Richard Donchian, consisting of an upper and lower band (channel boundaries) based on the maximum and minimum price values over a specific period.

To use the indicator, you need to use the DonchianChannels class.

Description

Donchian Channels are a simple yet effective volatility and trend indicator. The indicator consists of three lines:

- Upper line: highest high over the selected period

- Lower line: lowest low over the selected period

- Middle line: average value between the upper and lower lines

This indicator was first used by Richard Donchian in his 4-week channel rule, according to which a buy signal occurs when the price exceeds the highest high of 4 weeks, and a sell signal occurs when the price falls below the lowest low of 4 weeks.

Donchian Channels are useful for:

- Identifying market volatility

- Determining support and resistance levels

- Generating breakout signals

- Defining the current trading range

Parameters

The indicator has the following parameters:

- Length - calculation period (default value: 20)

Calculation

Donchian Channels calculation is quite simple:

Upper channel line:

Upper = Highest High over Length periodLower channel line:

Lower = Lowest Low over Length periodMiddle channel line:

Middle = (Upper + Lower) / 2

Interpretation

Donchian Channels can be used in various ways:

Breakout Strategies:

- Breaking above the upper channel line can be viewed as a buy signal

- Breaking below the lower channel line can be viewed as a sell signal

Trend Determination:

- If the price is in the upper half of the channel (above the middle line), an upward trend can be inferred

- If the price is in the lower half of the channel (below the middle line), a downward trend can be inferred

Support and Resistance Levels:

- The upper channel line can serve as a resistance level

- The lower channel line can serve as a support level

Volatility Measurement:

- Channel width (difference between upper and lower lines) indicates market volatility

- Channel expansion indicates increased volatility

- Channel contraction indicates decreased volatility

Counter-Trend Strategies:

- Some traders use opposite signals, expecting the price to return to the middle line after reaching the channel edges