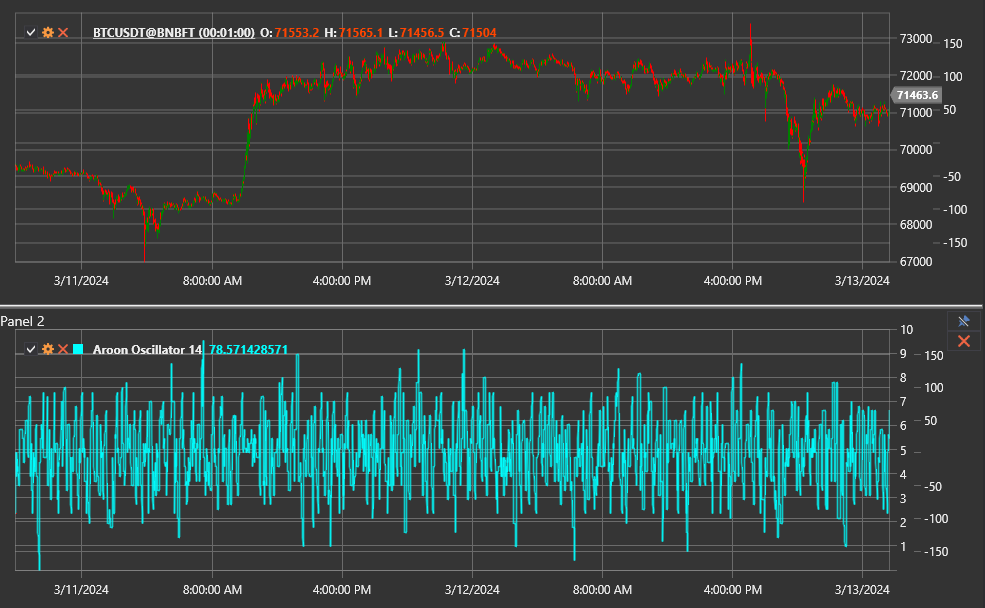

Aroon Oscillator

The Aroon Oscillator measures the difference between the Aroon Up and Aroon Down lines. It highlights which side of the market is dominant and how strong the current trend is.

Use the AroonOscillator class to work with this indicator.

Description

The oscillator oscillates between −100 and +100:

- positive values show that Aroon Up is above Aroon Down and the market is dominated by buyers;

- negative values indicate that Aroon Down is leading and the bears are in control;

- readings around zero reflect balance or consolidation.

The further the value moves away from zero, the stronger the directional move.

Parameters

- Length — period used for the underlying Aroon calculations. Larger values provide smoother readings with a slower response.

Calculation

- Calculate the Aroon Up and Aroon Down series with the selected

Length. - Subtract the two lines:

Aroon Oscillator = Aroon Up − Aroon Down.

Interpretation

- Aroon Oscillator > 0 — bullish dominance.

- Aroon Oscillator < 0 — bearish dominance.

- Zero-line cross — potential shift in the prevailing trend.

- Extreme values — strong directional trend, often used as a directional filter.

The oscillator is frequently analysed together with the base Aroon indicator to observe both absolute levels and their difference.