Continuous futures

The Hydra program allows the user to glue different types of market data on different contracts into one continuous instrument.

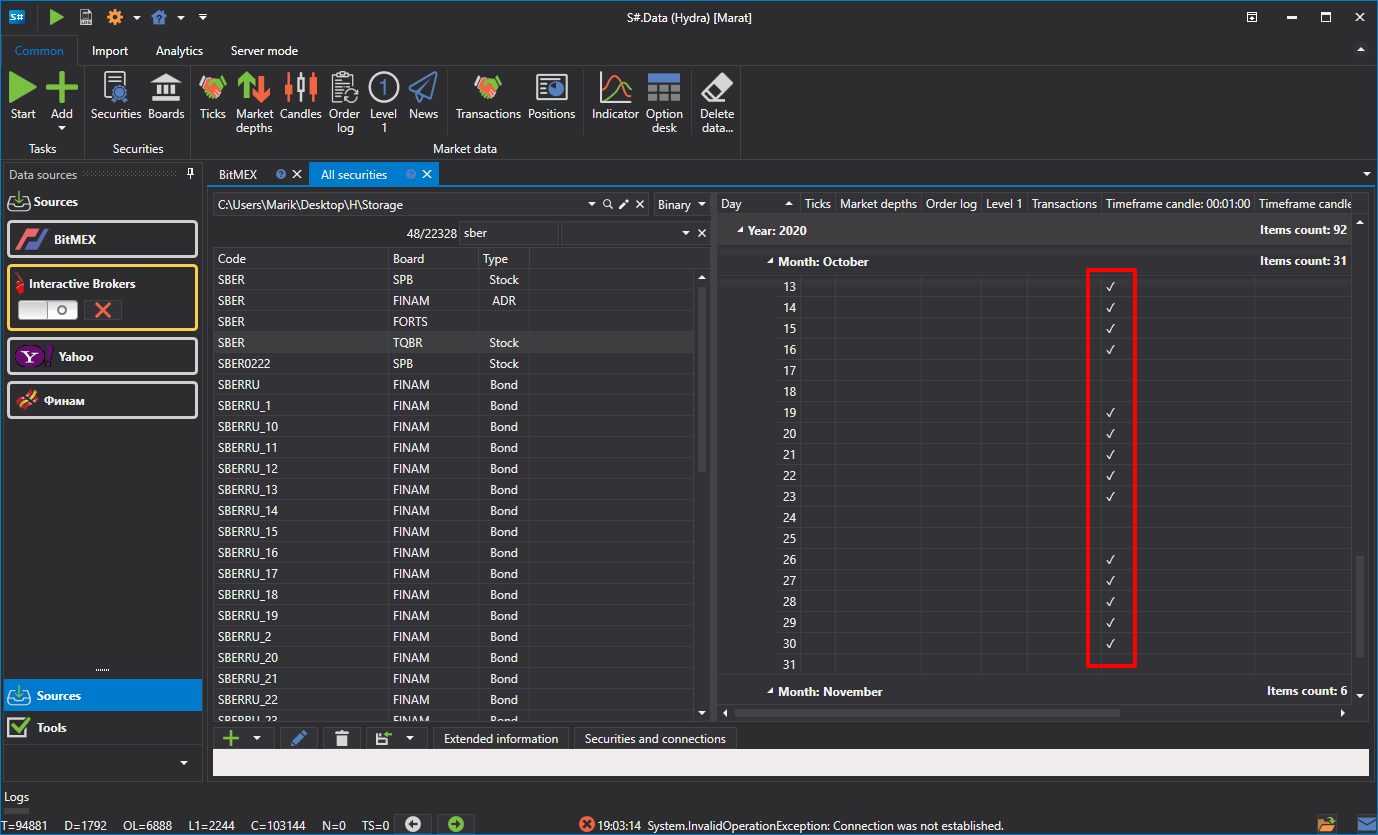

To do this, on the Common tab, select Securities, the All securities tab will appear. Before gluing the data, you need to check what market data is available. For this, the path is selected where the data is located and the instruments that are supposed to be glued are viewed in turn. If there are gaps, then you need to download the necessary market data (for example, from Финам).

As an example, we will consider gluing on an RTS index futures.

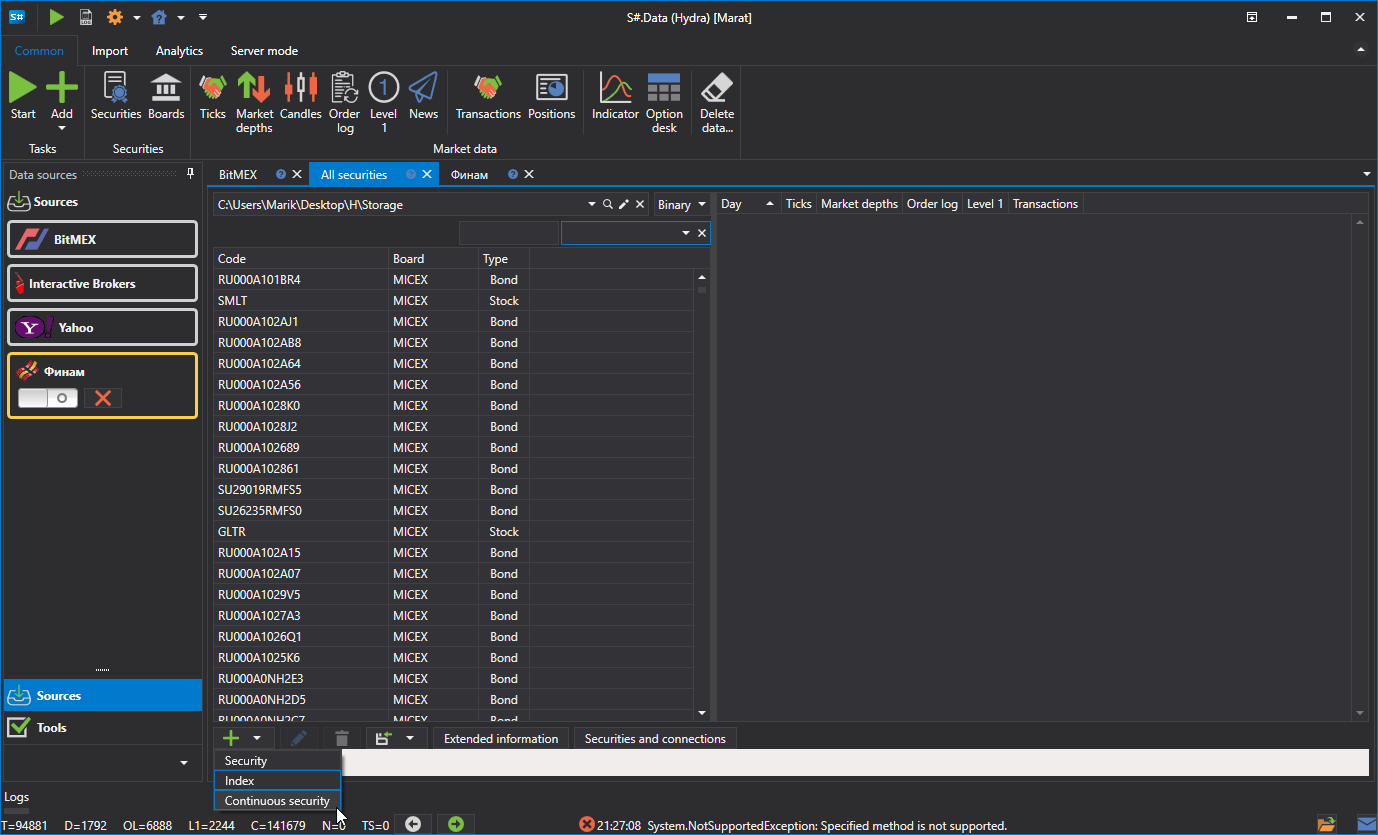

To create a continuous futures, click the Create security => Continuous security button on the All securities tab.

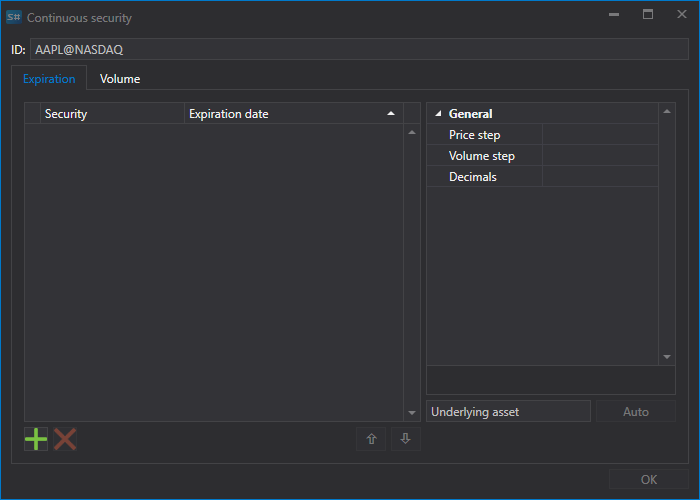

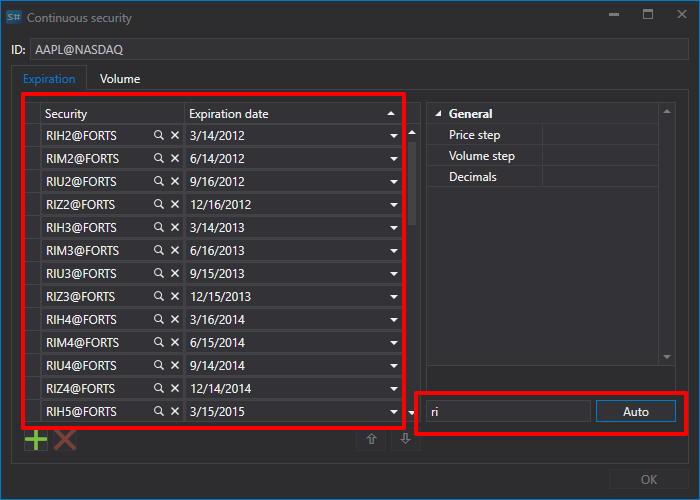

After that, the following window will appear:

2.To create a continuous futures, you need to specify a name and add contracts.

There are two ways to add contracts..

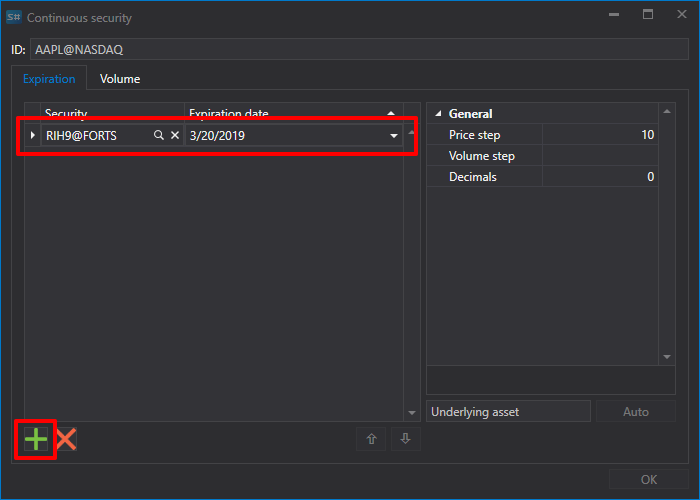

- Manually by clicking the

button.

button.

- If you set the first two letters of the contract as a name, for example, RI, and click the Auto button, then all the instruments found in the database will be added.

- Manually by clicking the

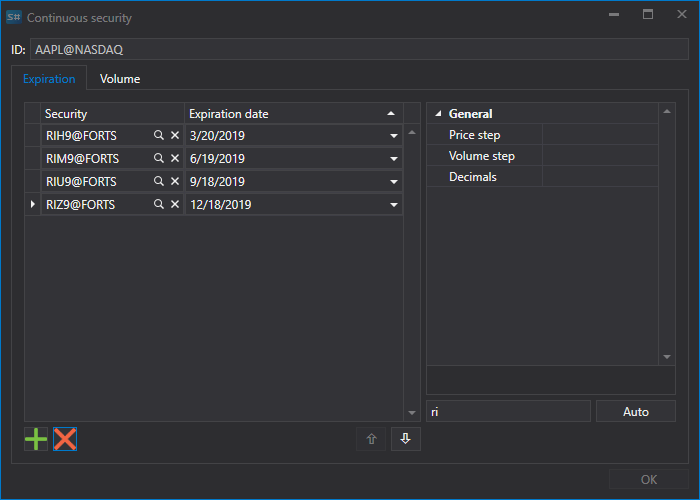

We select the necessary contracts and set the transition dates.

Next, assign the instrument identifier **RI_long9@FORTS** and click the OK button, after which a new instrument will be created

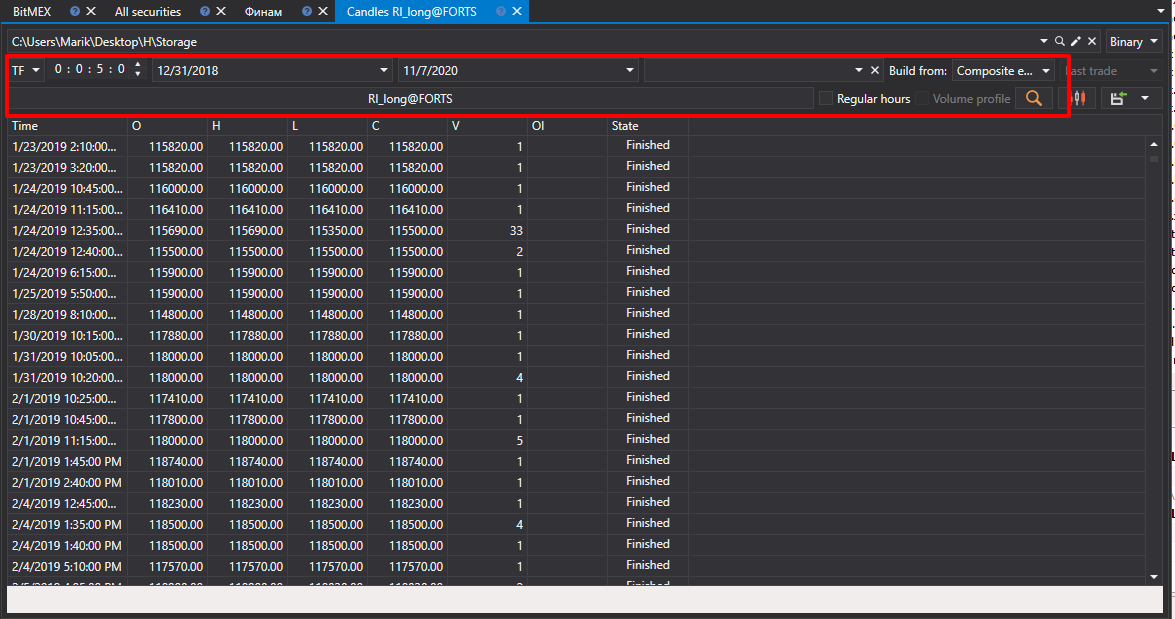

Next, you need to click the Candles button on the Common tab, select the resulting instrument, data period, set the Composite element value in the Build from field. Then click the

button.

button.

The generated data can be exported to Excel, xml, Json or txt formats. The export is performed using the drop-down list