Volume Profile

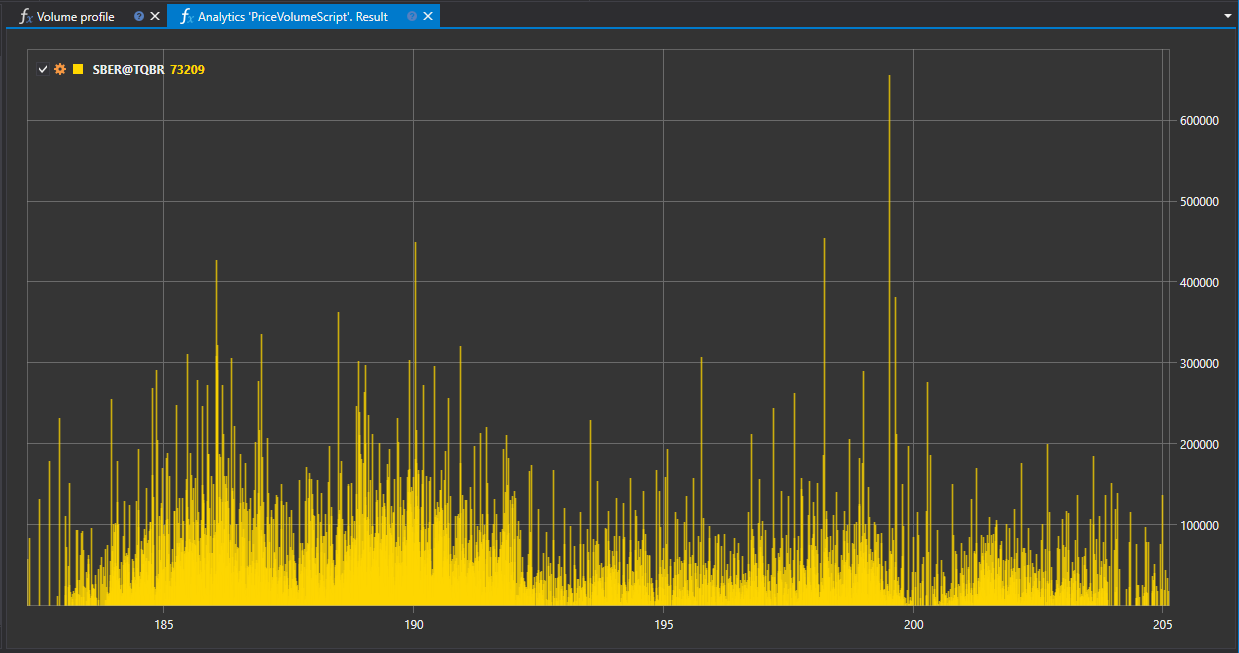

The "Volume Profile" script serves as a tool for analyzing the distribution of trading volume across price levels over a selected period. It enables traders and quantitative analysts to visualize and examine where the main trading activity was concentrated in terms of price levels.

Functionality Description

The script aggregates transaction data to form a profile that displays the volumes executed at various price levels. This information can be represented on a chart, illustrating the density of trades across different price points.

Practical Significance

Analyzing the volume profile helps in identifying key demand and supply zones and can be used for:

- Identifying support and resistance levels where the instrument finds significant interest from market participants.

- Assessing the strength of the current trend or its potential weakening, based on the change in volume distribution.

- Planning entry and exit points from the market, considering levels with maximum accumulated liquidity.

Application in Trading and Quantitative Analysis

- Trading: The volume profile can be utilized to develop strategies based on volume analysis, providing a clear view of where the main trading operations occur.

- Quantitative Analysis: Data on volume distribution can serve as input for quantitative models predicting the likelihood of price movements based on the volume accumulated at a level.

Script Implementation

The "Volume Profile" script performs the following steps:

- Data Collection: The script aggregates transaction data for the specified period.

- Profile Formation: Based on the collected data, the script forms a volume profile reflecting trading activity at each price level.

- Visualization: The results of the script's operation are visualized as a chart or histogram, where each bar corresponds to a specific price level and its trading volume.

Utilizing the "Volume Profile" script within the StockSharp platform allows for comprehensive market analysis, building well-founded trading hypotheses, and improving the quality of trading decisions made.

Script Code on C#

namespace StockSharp.Algo.Analytics

{

/// <summary>

/// The analytic script, calculating distribution of the volume by price levels.

/// </summary>

public class PriceVolumeScript : IAnalyticsScript

{

Task IAnalyticsScript.Run(ILogReceiver logs, IAnalyticsPanel panel, SecurityId[] securities, DateTime from, DateTime to, IStorageRegistry storage, IMarketDataDrive drive, StorageFormats format, TimeSpan timeFrame, CancellationToken cancellationToken)

{

if (securities.Length == 0)

{

logs.AddWarningLog("No instruments.");

return Task.CompletedTask;

}

// script can process only 1 instrument

var security = securities.First();

// get candle storage

var candleStorage = storage.GetTimeFrameCandleMessageStorage(security, timeFrame, drive, format);

// get available dates for the specified period

var dates = candleStorage.GetDates(from, to).ToArray();

if (dates.Length == 0)

{

logs.AddWarningLog("no data");

return Task.CompletedTask;

}

// grouping candles by middle price

var rows = candleStorage.Load(from, to)

.GroupBy(c => c.LowPrice + c.GetLength() / 2)

.ToDictionary(g => g.Key, g => g.Sum(c => c.TotalVolume));

// draw on chart

panel.CreateChart<decimal, decimal>()

.Append(security.ToStringId(), rows.Keys, rows.Values, DrawStyles.Histogram);

return Task.CompletedTask;

}

}

}

Script Code on Python

import clr

# Add .NET references

clr.AddReference("StockSharp.Messages")

clr.AddReference("StockSharp.Algo.Analytics")

clr.AddReference("Ecng.Drawing")

from Ecng.Drawing import DrawStyles

from System import TimeSpan

from System.Threading.Tasks import Task

from StockSharp.Algo.Analytics import IAnalyticsScript

from storage_extensions import *

from candle_extensions import *

from chart_extensions import *

from indicator_extensions import *

# The analytic script, calculating distribution of the volume by price levels.

class price_volume_script(IAnalyticsScript):

def Run(

self,

logs,

panel,

securities,

from_date,

to_date,

storage,

drive,

format,

time_frame,

cancellation_token

):

# Check if there are no instruments

if not securities:

logs.LogWarning("No instruments.")

return Task.CompletedTask

# Script can process only 1 instrument

security = securities[0]

# Get candle storage

candle_storage = get_tf_candle_storage(storage, security, time_frame, drive, format)

# Get available dates for the specified period

dates = get_dates(candle_storage, from_date, to_date)

if len(dates) == 0:

logs.LogWarning("no data")

return Task.CompletedTask

# Grouping candles by middle price and summing their volumes

candles = load_tf_candles(candle_storage, from_date, to_date)

rows_dict = {}

for candle in candles:

# Calculate middle price of the candle

key = candle.LowPrice + get_length(candle) / 2

# Sum volumes for same price level

rows_dict[key] = rows_dict.get(key, 0) + candle.TotalVolume

# Draw on chart

chart = create_chart(panel, float, float)

chart.Append(to_string_id(security), list(rows_dict.keys()), list(rows_dict.values()), DrawStyles.Histogram)

return Task.CompletedTask