Largest Candles

The "Largest Candles" script is designed to identify candles with the maximum volume and the greatest body length on the charts of selected financial instruments over a given period. This tool allows traders and analysts to identify significant market events and the reaction of market participants.

Key Features

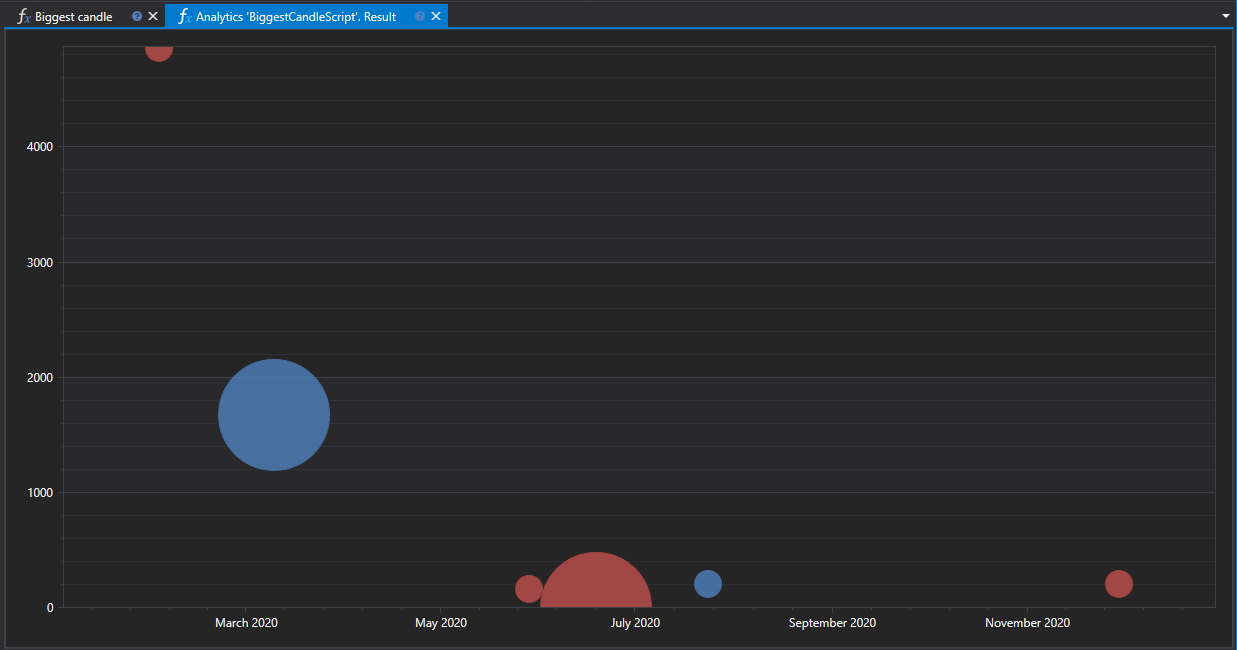

The script analyzes a set of specified instruments, searches among them for candles with the greatest volume and body length, and displays this data on two graphs:

- Candle Body Length Chart: Shows candles with the greatest difference between the opening and closing price.

- Trading Volume Chart: Demonstrates candles with the maximum trading volume for the existence time of the candle.

Workflow

- Selection of Instruments and Analysis Period: Determines the list of instruments and the time interval for analysis.

- Data Analysis: Involves loading and analyzing historical candle data to identify candles with the greatest indicators.

- Visualization of Results: Found candles are displayed on charts in the analytics panel interface.

Application

- Market Activity Analysis: Helps to determine moments of the greatest trader activity and potential market reversals.

- Key Levels Identification: Candles with significant volume and body length often form around key support and resistance levels.

- Strategic Planning: Information about the largest candles can be used for planning entry and exit points from the market, considering potential volatility.

Script Code on C#

namespace StockSharp.Algo.Analytics

{

/// <summary>

/// The analytic script, shows biggest candle (by volume and by length) for specified securities.

/// </summary>

public class BiggestCandleScript : IAnalyticsScript

{

Task IAnalyticsScript.Run(ILogReceiver logs, IAnalyticsPanel panel, SecurityId[] securities, DateTime from, DateTime to, IStorageRegistry storage, IMarketDataDrive drive, StorageFormats format, TimeSpan timeFrame, CancellationToken cancellationToken)

{

if (securities.Length == 0)

{

logs.AddWarningLog("No instruments.");

return Task.CompletedTask;

}

var priceChart = panel.CreateChart<DateTimeOffset, decimal, decimal>();

var volChart = panel.CreateChart<DateTimeOffset, decimal, decimal>();

var bigPriceCandles = new List<CandleMessage>();

var bigVolCandles = new List<CandleMessage>();

foreach (var security in securities)

{

// stop calculation if user cancel script execution

if (cancellationToken.IsCancellationRequested)

break;

// get candle storage

var candleStorage = storage.GetTimeFrameCandleMessageStorage(security, timeFrame, drive, format);

var allCandles = candleStorage.Load(from, to).ToArray();

// first orders by volume desc will be our biggest candle

var bigPriceCandle = allCandles.OrderByDescending(c => c.GetLength()).FirstOrDefault();

var bigVolCandle = allCandles.OrderByDescending(c => c.TotalVolume).FirstOrDefault();

if (bigPriceCandle != null)

bigPriceCandles.Add(bigPriceCandle);

if (bigVolCandle != null)

bigVolCandles.Add(bigVolCandle);

}

// draw series on chart

priceChart.Append("prices", bigPriceCandles.Select(c => c.OpenTime), bigPriceCandles.Select(c => c.GetMiddlePrice(null)), bigPriceCandles.Select(c => c.GetLength()));

volChart.Append("prices", bigVolCandles.Select(c => c.OpenTime), bigPriceCandles.Select(c => c.GetMiddlePrice(null)), bigVolCandles.Select(c => c.TotalVolume));

return Task.CompletedTask;

}

}

}

Script Code on Python

import clr

# Add .NET references

clr.AddReference("StockSharp.Messages")

clr.AddReference("StockSharp.Algo.Analytics")

clr.AddReference("Ecng.Drawing")

from Ecng.Drawing import DrawStyles

from System import TimeSpan

from System.Threading.Tasks import Task

from StockSharp.Algo.Analytics import IAnalyticsScript

from storage_extensions import *

from candle_extensions import *

from chart_extensions import *

from indicator_extensions import *

# The analytic script, shows biggest candle (by volume and by length) for specified securities.

class biggest_candle_script(IAnalyticsScript):

def Run(self, logs, panel, securities, from_date, to_date, storage, drive, format, time_frame, cancellation_token):

if not securities:

logs.LogWarning("No instruments.")

return Task.CompletedTask

price_chart = create_3d_chart(panel, datetime, float, float)

vol_chart = create_3d_chart(panel, datetime, float, float)

big_price_candles = []

big_vol_candles = []

for security in securities:

# stop calculation if user cancel script execution

if cancellation_token.IsCancellationRequested:

break

# get candle storage

candle_storage = get_tf_candle_storage(storage, security, time_frame, drive, format)

all_candles = load_tf_candles(candle_storage, from_date, to_date)

if len(all_candles) > 0:

# first orders by volume desc will be our biggest candle

big_price_candle = max(all_candles, key=lambda c: get_length(c))

big_vol_candle = max(all_candles, key=lambda c: c.TotalVolume)

if big_price_candle is not None:

big_price_candles.append(big_price_candle)

if big_vol_candle is not None:

big_vol_candles.append(big_vol_candle)

# draw series on chart

price_chart.Append(

"prices",

[c.OpenTime for c in big_price_candles],

[get_middle_price(c) for c in big_price_candles],

[get_length(c) for c in big_price_candles]

)

vol_chart.Append(

"prices",

[c.OpenTime for c in big_vol_candles],

[get_middle_price(c) for c in big_price_candles],

[c.TotalVolume for c in big_vol_candles]

)

return Task.CompletedTask