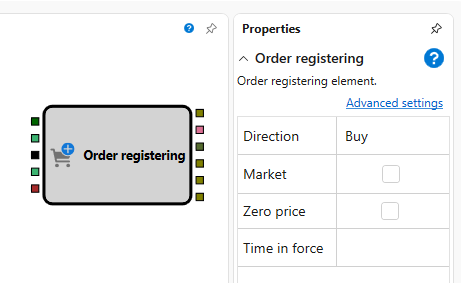

Order Registration

The "Order Registration" component is used for placing trading orders for a selected instrument.

Input Sockets

- Instrument – The selected instrument for the order.

- Price – Specifies the price for a limit order.

- Trigger – Activation signal for the order, accepts any value except

False. - Volume – The quantity of instruments for the order.

- Portfolio – The portfolio within which the order will be placed.

Output Sockets

- Order – Information about the placed order.

- Error – Information about any error during order registration.

- Transaction – Information about the transaction made on the order.

- Cancellation – Signal that the order has been cancelled.

- Executed – Signal that the order has been fully executed.

- Completed – Signal that combines events of error, cancellation, or full execution of the order.

Parameters

- Direction – Determines whether the order is for buying or selling.

- Market Order – Indicates whether the order is a market order.

- Zero Price – If the price is set to zero, the order is registered as a market order.

- Lifetime – The duration for which a limit order remains active.

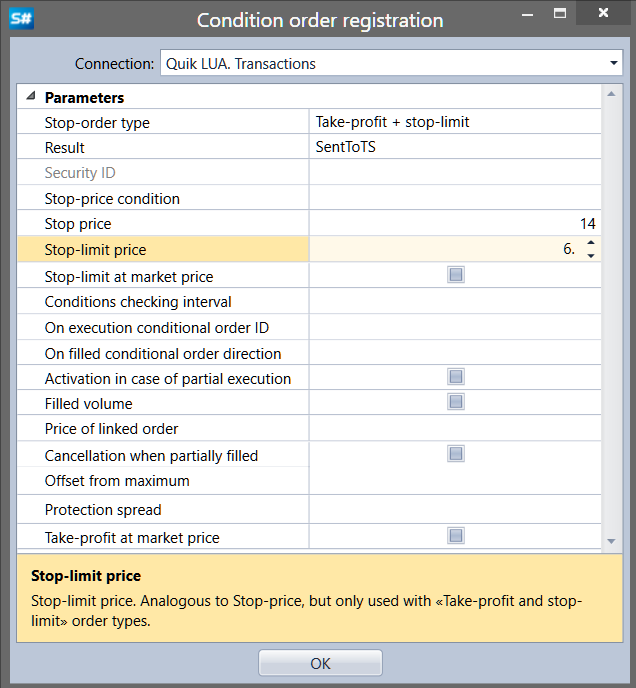

Conditional Order Setup

Conditional Order – An order with additional conditions determining the timing of placement in the trading system based on the current market situation.

- Connection – The connection where the order will be placed.

- Stop Order Type – The type of stop order.

- Result – The outcome of the executed stop order.

- Instrument Identifier – The identifier for the instrument for stop orders with conditions related to another instrument.

- Stop Price Condition – The stop price condition. Used for orders like "Stop price for another instrument."

- Stop Price – The stop price that sets the condition for triggering the stop order.

- Stop-Limit Price – Similar to the Stop Price but used only for "Take-profit and stop-limit" type orders.

- Stop-Limit at Market Price – Indicates if the "Stop-Limit" order executes at the market price.

- Condition Check Interval – The time interval for checking the conditions of the order only within the specified period (if null, then no checks). Used for "Take-profit and stop-limit" and "Take-profit and stop-limit by order" types.

- Conditional Order Execution Identifier – The identifier for the conditional order based on execution.

- Direction of Conditional Order by Execution – The direction of the conditional order based on execution.

- Activation on Partial Execution – Partial execution of the order is considered. An "on-execution" order will be activated upon partial execution of the condition order.

- Executed Volume – Takes the executed volume of the order as the quantity for placing the stop order. The quantity of securities in an "on-execution" order is taken as the executed volume of the condition order.

- Price of Linked Order – The price of the linked limit order.

- Withdrawal on Partial Execution – Indicates the withdrawal of the stop order upon partial execution of the linked limit order.

- Offset from Maximum – The amount of offset from the maximum (minimum) price of the last transaction.

- Protective Spread – The size of the protective spread.

- Take-Profit at Market Price – Indicates if the "Take-Profit" order executes at the market price.

Note

Working with orders is a low-level method of managing positions. For higher-level management, it is recommended to use the "Modify Position" component, described in Modify Position.