Optimization

To optimize the backtesting process it is possible to use parallel computation based on multiple threads. On computers with multiple cores or processors this will reduce the overall testing time due to concurrent execution of multiple operations.

Caution

Using multiple threads increases the memory consumption (approximately as many times as threads created, if each thread uses its time range in the history). Therefore, the use of parallel testing without sufficient memory, will not allow a significant increase in performance, and even reduce it.

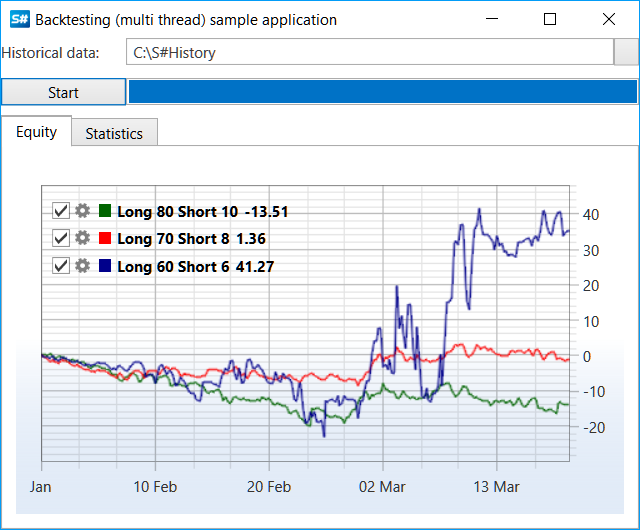

Example of moving averages strategy testing in several threads

The SampleHistoryTesting example, described in the Historical data testing section, is taken as the basis. This example is a modified conventional testing for testing with optimization through fitting of the optimum value of the moving averages lengths:

Creating a few settings of the moving averages lengths (the first value is responsible for the length of the longest, the second for the length of the shortest, and the third for the equity curve color):

var periods = new[] { new Tuple<int, int, Color>(80, 10, Colors.DarkGreen), new Tuple<int, int, Color>(70, 8, Colors.Red), new Tuple<int, int, Color>(60, 6, Colors.DarkBlue) };Creating an instance of the storage, the instrument, the message to set the values of Level1 and the portfolio:

// storage to historical data var storageRegistry = new StorageRegistry { // set historical path DefaultDrive = new LocalMarketDataDrive(HistoryPath.Folder) }; var timeFrame = TimeSpan.FromMinutes(5); // create test security var security = new Security { Id = "ESM2@NYSE", // sec id has the same name as folder with historical data Code = "ESM2", Name = "ES-12.12", Board = ExchangeBoard.Nyse, }; var startTime = new DateTime(2012, 10, 1); var stopTime = new DateTime(2012, 10, 31); var level1Info = new Level1ChangeMessage { SecurityId = security.ToSecurityId(), ServerTime = startTime, } .TryAdd(Level1Fields.PriceStep, 10m) .TryAdd(Level1Fields.StepPrice, 6m) .TryAdd(Level1Fields.MinPrice, 10m) .TryAdd(Level1Fields.MaxPrice, 1000000m) .TryAdd(Level1Fields.MarginBuy, 10000m) .TryAdd(Level1Fields.MarginSell, 10000m); // test portfolio var portfolio = new Portfolio { Name = "test account", BeginValue = 1000000, };Creating a unified connector BatchEmulation, which will contain all created in the next step HistoryEmulationConnector:

// create backtesting connector var batchEmulation = new BatchEmulation(new[] { security }, new[] { portfolio }, storageRegistry) { EmulationSettings = { MarketTimeChangedInterval = timeFrame, StartTime = startTime, StopTime = stopTime, // count of parallel testing strategies BatchSize = periods.Length, } };Next, the subscription to the unified gateway and the connector events is performed, testing parameters are configured, as well as the strategy is created for each period.

// handle historical time for update ProgressBar batchEmulation.ProgressChanged += (curr, total) => this.GuiAsync(() => TestingProcess.Value = total); batchEmulation.StateChanged += (oldState, newState) => { if (batchEmulation.State != EmulationStates.Stopped) return; this.GuiAsync(() => { if (batchEmulation.IsFinished) { TestingProcess.Value = TestingProcess.Maximum; MessageBox.Show(this, LocalizedStrings.Str3024.Put(DateTime.Now - _startEmulationTime)); } else MessageBox.Show(this, LocalizedStrings.cancelled); }); }; // get emulation connector var connector = batchEmulation.EmulationConnector; logManager.Sources.Add(connector); connector.SecurityReceived += (sub, s) => { if (s != security) return; // fill level1 values connector.SendInMessage(level1Info); connector.MarketDataAdapter.SendInMessage(new GeneratorMessage { IsSubscribe = true, Generator = new RandomWalkTradeGenerator(new SecurityId { SecurityCode = security.Code }) { Interval = TimeSpan.FromSeconds(1), MaxVolume = maxVolume, MaxPriceStepCount = 3, GenerateOriginSide = true, MinVolume = minVolume, RandomArrayLength = 99, } }); }; TestingProcess.Maximum = 100; TestingProcess.Value = 0; _startEmulationTime = DateTime.Now; var strategies = periods .Select(period => { ... // create strategy based SMA var strategy = new SmaStrategy(series, new SimpleMovingAverage { Length = period.Item1 }, new SimpleMovingAverage { Length = period.Item2 }) { Volume = 1, Security = security, Portfolio = portfolio, Connector = connector, // by default interval is 1 min, // it is excessively for time range with several months UnrealizedPnLInterval = ((stopTime - startTime).Ticks / 1000).To<TimeSpan>() }; ... var curveItems = Curve.CreateCurve(LocalizedStrings.Str3026Params.Put(period.Item1, period.Item2), period.Item3, DrawStyles.Line); strategy.PnLChanged += () => { var data = new EquityData { Time = strategy.CurrentTime, Value = strategy.PnL, }; this.GuiAsync(() => curveItems.Add(data)); }; Stat.AddStrategies(new[] { strategy }); return strategy; });The testing starts:

// start emulation batchEmulation.Start(strategies, periods.Length);