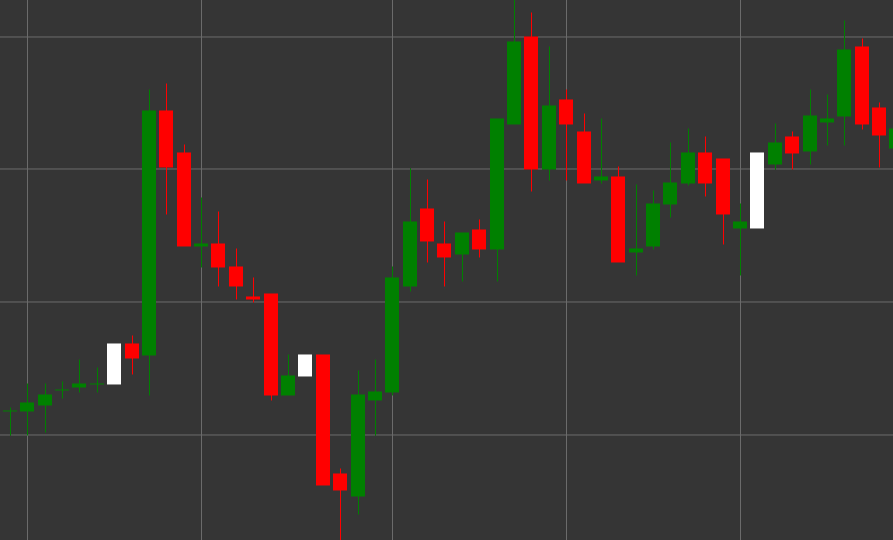

Pattern White Marubozu

White Marubozu is a bullish candlestick pattern characterized by the absence of shadows on both ends of the candle. The term "marubozu" comes from the Japanese word meaning "bald-headed" or "shaved," reflecting the appearance of the candle without shadows.

Key Features:

- Opening price is lower than closing price (O < C).

- The candle body is completely filled, without upper and lower shadows.

- Opening price equals the low of the candle, and closing price equals the high of the candle.

- Represents a strong bullish movement, where buyers controlled the price throughout the period.

Interpretation

White Marubozu is considered a strong bullish signal:

- The absence of shadows indicates complete buyer domination - the price opened at the low and continuously rose until the period closed.

- A long White Marubozu indicates very strong bullish pressure.

- The appearance of this pattern after a downtrend may signal a reversal.

- Within an uptrend, it confirms the strength of the movement.

Trading Strategies

White Marubozu provides a stronger signal than a regular white candle:

- Opportunity to enter a long position after the formation of a White Marubozu, especially if it appears at an important support level.

- Using the closing price of White Marubozu as a support level when setting stop-losses.

- Combining with other technical indicators to confirm the signal.

- Paying attention to trading volume - high volume enhances the significance of the signal.