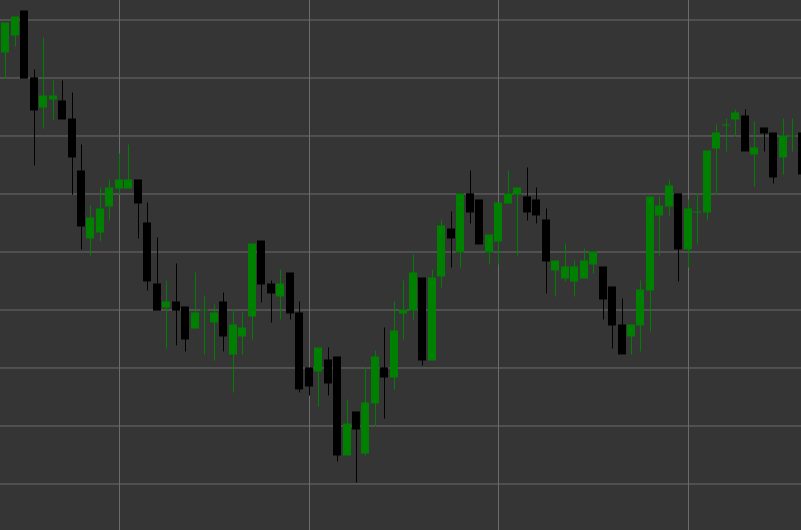

Pattern Black Candle

Black Candle (bearish candle) is a classic candlestick pattern that forms when the closing price is lower than the opening price. This candle reflects a bearish market sentiment, where sellers controlled the price during the period of candle formation.

Key Features:

- Opening price is higher than closing price (O > C).

- The candle body is usually colored black (or red in modern charts).

- Indicates the predominance of sellers over buyers.

- The size of the candle body shows the strength of the bearish movement.

Interpretation

Black Candle signals bearish pressure in the market:

- The longer the candle body, the stronger the bearish pressure.

- A long black candle after an uptrend may indicate a potential reversal.

- The presence of short shadows indicates that bears controlled the price throughout the period.

- Consecutive black candles indicate a steady downtrend.

Trading Strategies

Although a single black candle is not usually an independent trading signal, it can be used as part of a broader strategy:

- Confirmation of a downtrend or reversal after an upward movement.

- Looking for long black candles at resistance levels for potential short positions.

- Using in combination with other candlestick patterns, for example, a black candle after a bearish engulfing.

- Identifying support levels after a series of consecutive black candles.