Volatility trading

For option quoting, a special VolatilityQuotingStrategy strategy is implemented, which provides volume quoting within the specified range of volatility.

Quoting by volatility

The S# installation package includes the example SampleOptionQuoting, which quotes the selected strike within the specified range of volatility.

Creating a connection to the OpenECry and starting the export:

private void InitConnector() { // subscribe on connection successfully event Connector.Connected += () => { // update gui labels this.GuiAsync(() => ChangeConnectStatus(true)); }; // subscribe on disconnection event Connector.Disconnected += () => { // update gui labels this.GuiAsync(() => ChangeConnectStatus(false)); }; // subscribe on connection error event Connector.ConnectionError += error => this.GuiAsync(() => { // update gui labels ChangeConnectStatus(false); MessageBox.Show(this, error.ToString(), LocalizedStrings.ErrorConnection); }); // fill underlying asset's list Connector.SecurityReceived += (sub, security) => { if (security.Type == SecurityTypes.Future) _assets.Add(security); }; Connector.Level1Received += (sub, security) => { if (_model.UnderlyingAsset == security || _model.UnderlyingAsset.Id == security.UnderlyingSecurityId) _isDirty = true; }; // subscribing on tick prices and updating asset price Connector.TickTradeReceived += (sub, trade) => { if (_model.UnderlyingAsset == trade.Security || _model.UnderlyingAsset.Id == trade.Security.UnderlyingSecurityId) _isDirty = true; }; Connector.NewPosition += position => this.GuiAsync(() => { var asset = SelectedAsset; if (asset == null) return; var assetPos = position.Security == asset; var newPos = position.Security.UnderlyingSecurityId == asset.Id; if (!assetPos && !newPos) return; if (assetPos) PosChart.AssetPosition = position; if (newPos) PosChart.Positions.Add(position); RefreshChart(); }); Connector.PositionChanged += position => this.GuiAsync(() => { if ((PosChart.AssetPosition != null && PosChart.AssetPosition == position) || PosChart.Positions.Cache.Contains(position)) RefreshChart(); }); try { if (File.Exists(_settingsFile)) Connector.Load(new JsonSerializer<SettingsStorage>().Deserialize(_settingsFile)); } catch { } } private void ConnectClick(object sender, RoutedEventArgs e) { if (!_isConnected) { ConnectBtn.IsEnabled = false; _model.Clear(); _model.MarketDataProvider = Connector; ClearSmiles(); PosChart.Positions.Clear(); PosChart.AssetPosition = null; PosChart.Refresh(1, 1, default(DateTimeOffset), default(DateTimeOffset)); Portfolio.Portfolios = new PortfolioDataSource(Connector); PosChart.MarketDataProvider = Connector; PosChart.SecurityProvider = Connector; Connector.Connect(); } else Connector.Disconnect(); }Set up the VolatilityQuotingStrategy strategy (filling the range of volatility, as well as the creation of the order, wherethrough the required volume and quoting direction are specified):

private void StartClick(object sender, RoutedEventArgs e) { var option = SelectedOption; // create DOM window var wnd = new QuotesWindow { Title = option.Name }; wnd.Init(option); // create delta hedge strategy var hedge = new DeltaHedgeStrategy { Security = option.GetUnderlyingAsset(Connector), Portfolio = Portfolio.SelectedPortfolio, Connector = Connector, }; // create option quoting for 20 contracts var quoting = new VolatilityQuotingStrategy(Sides.Buy, 20, new Range<decimal>(ImpliedVolatilityMin.Value ?? 0, ImpliedVolatilityMax.Value ?? 100)) { // working size is 1 contract Volume = 1, Security = option, Portfolio = Portfolio.SelectedPortfolio, Connector = Connector, }; // link quoting and hedging hedge.ChildStrategies.Add(quoting); // start hedging hedge.Start(); wnd.Closed += (s1, e1) => { // force close all strategies while the DOM was closed hedge.Stop(); }; // show DOM wnd.Show(); }Starting quoting:

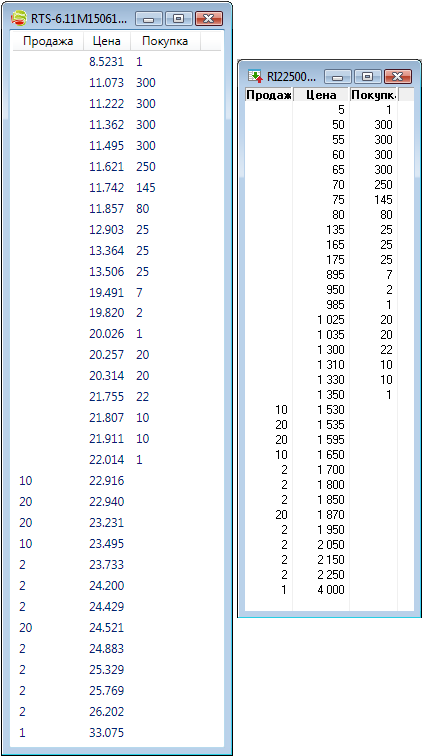

hedge.Start();For a visual presentation of the volatility the example shows how you can convert the standard order book with quotations to the order book of volatility through the use of the DerivativesHelper.ImpliedVolatility(StockSharp.Messages.IOrderBookMessage depth, StockSharp.BusinessEntities.ISecurityProvider securityProvider, StockSharp.BusinessEntities.IMarketDataProvider dataProvider, StockSharp.BusinessEntities.IExchangeInfoProvider exchangeInfoProvider, System.DateTimeOffset currentTime, System.Decimal riskFree, System.Decimal dividend ) method:

private void OnQuotesChanged() { DepthCtrl.UpdateDepth(_depth.ImpliedVolatility(Connector, Connector, Connector.CurrentTime)); }

Ending quoting and stopping the strategy:

hedge.Stop();