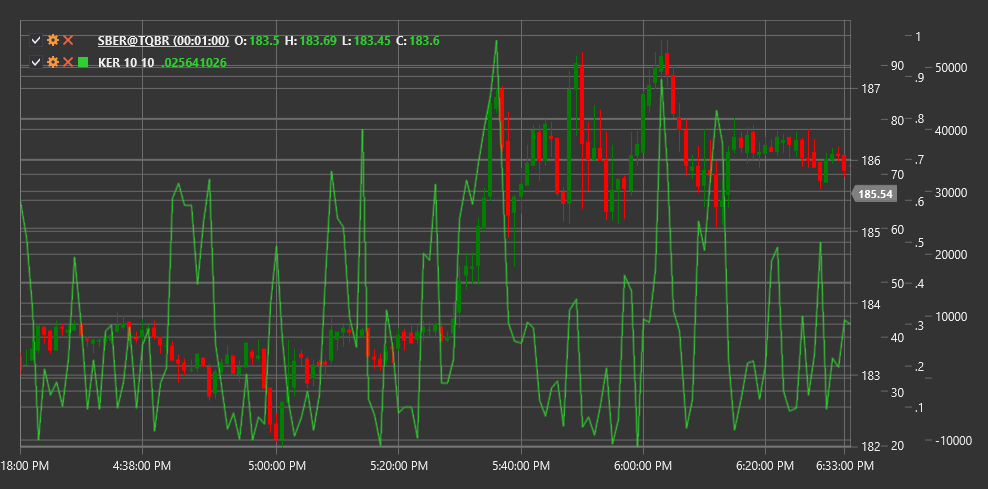

KER

Kaufman Efficiency Ratio (KER) is a technical indicator developed by Perry Kaufman that measures price movement efficiency by comparing directional price movement to overall volatility.

To use the indicator, you need to use the KaufmanEfficiencyRatio class.

Description

The Kaufman Efficiency Ratio (KER) evaluates how "efficiently" price moves in a specific direction compared to the total path it travels. It represents the ratio of net directional price movement to the sum of all price changes over a specific period.

KER was developed by Perry Kaufman and was originally used as a component of the Adaptive Moving Average (KAMA). However, KER itself is a valuable tool that helps determine whether the market is in a trending or oscillating state.

KER values oscillate between 0 and 1:

- Values close to 1 indicate highly efficient price movement (strong trend)

- Values close to 0 indicate inefficient price movement (sideways market or high volatility)

Parameters

The indicator has the following parameters:

- Length - period for efficiency calculation (default value: 10)

Calculation

Kaufman Efficiency Ratio calculation involves the following steps:

Calculate directional movement (net change) over the period:

Direction = |Price[current] - Price[current - Length]|Calculate total movement (sum of all changes) over the period:

Volatility = Sum(|Price[i] - Price[i-1]|) for i from (current - Length + 1) to currentCalculate efficiency ratio:

KER = Direction / Volatility

Where:

- Price - usually closing price

- Length - calculation period

- | | - denotes absolute value

If Volatility is zero (which is unlikely), KER is set to zero to avoid division by zero.

Interpretation

The Kaufman Efficiency Ratio can be interpreted as follows:

Efficiency Levels:

- High KER values (>0.6) indicate a strong trend

- Medium KER values (0.3-0.6) indicate a moderate trend

- Low KER values (<0.3) indicate a sideways market or high volatility

KER Changes:

- KER growth may signal the formation or strengthening of a trend

- KER decline may signal trend weakening or transition to sideways movement

Trading Strategies:

- During high efficiency periods (high KER), trend strategies are preferable

- During low efficiency periods (low KER), range trading strategies are preferable

Signal Filtering:

- KER can be used to filter signals from other indicators

- Trend indicator signals are more reliable at high KER

- Oscillator signals are more reliable at low KER

Market Condition Adaptation:

- KER allows adapting trading strategies to changing market conditions

- Traders can dynamically adjust parameters of other indicators based on KER values

Change Precursor:

- Sharp KER changes often precede new price movements

- KER decline after a period of high values may warn of a potential trend reversal