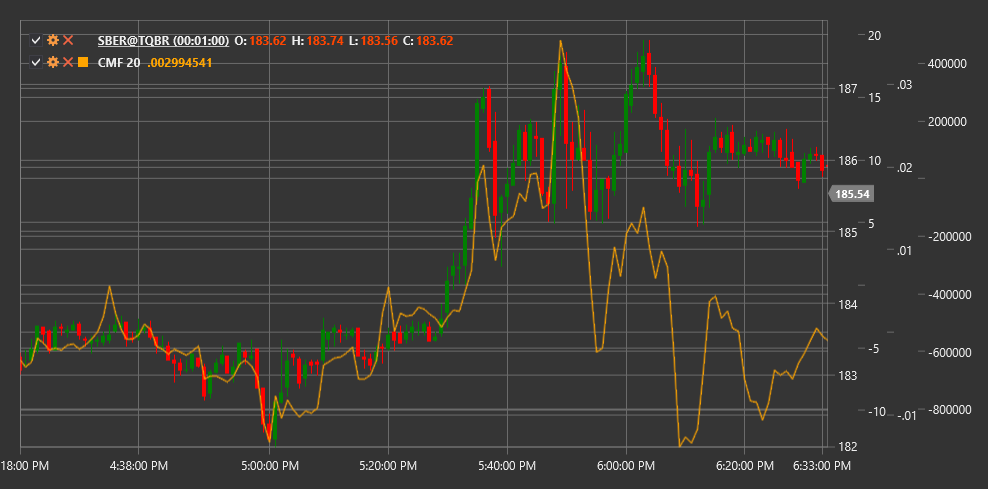

CMF

Chaikin Money Flow (CMF) is a technical indicator developed by Mark Chaikin that measures the strength of money flow (accumulation and distribution) in the market over a specific period.

To use the indicator, you need to use the ChaikinMoneyFlow class.

Description

Chaikin Money Flow (CMF) expands on the concept of the Accumulation/Distribution Line (A/D Line), focusing on a specific time period. The indicator measures money flow volume expressed as a percentage of total volume over the specified period.

CMF helps traders:

- Determine the strength of buying and selling pressure

- Identify accumulation (buying) and distribution (selling) trends

- Detect divergences between price movement and money flow

- Confirm the current trend or its weakness

The key idea of CMF is that in a strong upward trend, the closing price should be closer to the period's high, while in a strong downward trend, it should be closer to the period's low.

Parameters

The indicator has the following parameters:

- Length - calculation period (standard value: 20-21 days)

Calculation

CMF calculation involves the following steps:

Calculate Money Flow Multiplier for each period:

Money Flow Multiplier = ((Close - Low) - (High - Close)) / (High - Low)If (High - Low) = 0, then Money Flow Multiplier = 0.

Calculate Money Flow Volume for the period:

Money Flow Volume = Money Flow Multiplier * VolumeCalculate Chaikin Money Flow:

CMF = Sum(Money Flow Volume over Length period) / Sum(Volume over Length period)

Interpretation

CMF oscillates around the zero line and is typically within the range of -1 to +1:

Positive CMF values (above zero):

- Indicate buyer pressure (accumulation)

- The higher the value, the stronger the buyer pressure

- Particularly significant if sustained for a prolonged period

Negative CMF values (below zero):

- Indicate seller pressure (distribution)

- The lower the value, the stronger the seller pressure

- Prolonged stay in the negative zone confirms a downward trend

Zero Line Crossing:

- Crossing from bottom to top may indicate the start of an upward trend

- Crossing from top to bottom may signal the beginning of a downward trend

Divergences:

- Bullish Divergence: price declines while CMF rises (potential upward reversal)

- Bearish Divergence: price rises while CMF falls (potential downward reversal)

Extreme Levels:

- Values above +0.25 may indicate strong accumulation

- Values below -0.25 may indicate strong distribution