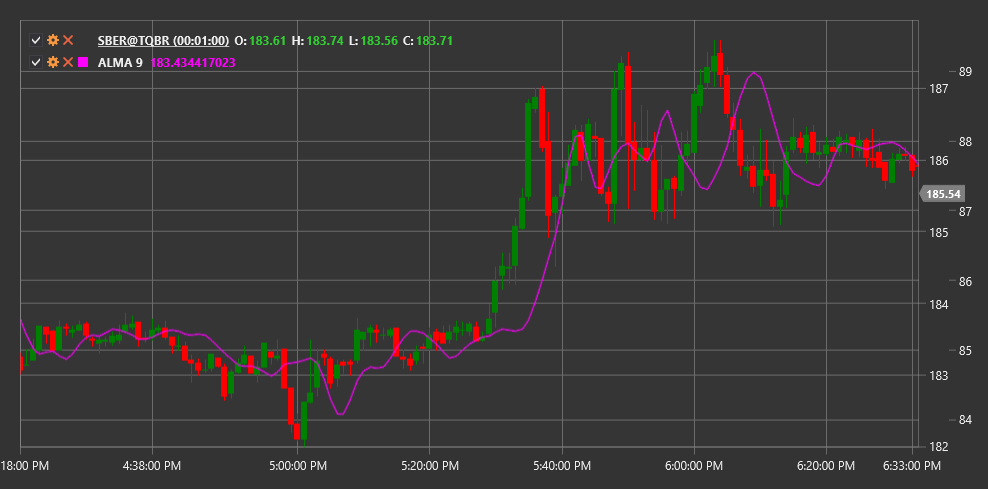

ALMA

Arnaud Legoux Moving Average (ALMA) is an indicator developed by Arnaud Legoux and optimized to eliminate market noise and reduce signal lag.

To use the indicator, you need to use the ArnaudLegouxMovingAverage class.

Description

ALMA combines the advantages of two data smoothing approaches:

- Eliminating market noise (like most moving averages)

- Minimizing lag (typical of many smoothing indicators)

The ALMA indicator uses a normal (Gaussian) distribution as a weight function, which can be fine-tuned using offset and sigma parameters. This makes it a very flexible and effective tool for technical analysis.

ALMA is used for:

- Determining the current trend

- Identifying reversal points

- Creating trading systems based on crossovers

Parameters

The indicator has the following parameters:

- Length - calculation period (number of candles to analyze)

- Sigma - sigma, a parameter controlling the shape of the Gaussian curve (recommended value: 6)

- Offset - offset, a parameter controlling smoothing and response speed (recommended value: 0.85)

Calculation

The ALMA calculation occurs in several stages:

Determining weights for each data point in the window based on normal (Gaussian) distribution:

m = floor(Offset * (Length - 1)) s = Length / Sigma For each i from 0 to Length-1: w(i) = exp(-((i - m)^2) / (2 * s^2))Normalizing weights:

Sum_of_weights = sum of all w(i) For each i from 0 to Length-1: w_norm(i) = w(i) / Sum_of_weightsCalculating ALMA as a weighted sum:

ALMA = sum(Price(t-i) * w_norm(i)) for all i from 0 to Length-1

Where:

- Length - ALMA period

- Offset - offset parameter (from 0 to 1)

- Sigma - sigma parameter (usually from 2 to 8)